Debt yield calculation

The debt yield formula is. A propertys net operating income.

Cost Of Debt Definition Formula Calculation Example

D Discount F Face value t Number of days until maturity beginaligned textAnnualized Bank Discount Yield.

. Debt Yield Net Operating Income Loan Amount Most. Figure out the Net Operating Income of the subject property. How to Calculate the Debt Yield in Mortgage Markets The formula is as follows.

To calculate a propertys debt yield you must divide the propertys net operating income NOI by the total loan amount. Debt Yield DY Net Operating Income NOI Loan Amount LA All things being equal the higher the debt yield the less risky the loan. Debt Yield Net Operating Income NOI Loan Amount While its very easy to calculate the lender must determine if the.

Debt Yield Calculation means with respect to any six 6 month----- period the quotient of i annualized Net Operating Income divided by ii the ----- -- outstanding principal balance of the. To determine a propertys debt yield you take the propertys net operating income NOI and divide it by the total loan amount. The Debt Yield Formula The debt yield can be calculated by dividing a propertys yearly net operating income NOI by the total loan amount.

Debt Yield Net Operating Income Loan Amount. This is the underwritten cash flow of the property. How to Calculate Debt Yield.

So if a commercial propertys net. Debt yield calculation The formula for debt yield is. To determine a propertys debt yield you take the propertys net operating income NOI and divide it by the total loan amount.

Its calculated by dividing net operating income by the outstanding loan balance and is expressed as a percentage. Bank Discount Yield BDY The BDY formula is best suited to calculating yield on short-term debt instruments such as government T-bills. To calculate the debt yield of a property simply divide its net operating income by the total loan amount.

Debt Yield is a risk metric used to estimate the return that a lender would earn should they have to take a property back in foreclosure. So if a commercial propertys net operating income was. NOI Net Operating Income So as an example lets say that the commercial propertys NOI is 200000.

As previously mentioned debt yield is calculated by taking a propertys NOI and dividing it by the total loan amount. The formula used to calculate debt. Annualized Bank Discount Yield D F 360 t where.

Next divide the Net Operating income by the. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. The math required for a debt yield calculation is simple and easy.

For example if a propertys net operating income is. In this example well use 500000. Build Your Future With A Firm That Has 85 Years Of Investing Experience.

For instance if a commercial propertys net operating income was 200000. Debt yield is defined as a propertys net operating income divided by the total loan amount. Heres the formula for debt yield.

What Are the DYR Components. For example if a commercial propertys net operating income is. The formula simply stated is.

The bond yield can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvesting the coupons at the same interest rate. The formula for calculating BDY is.

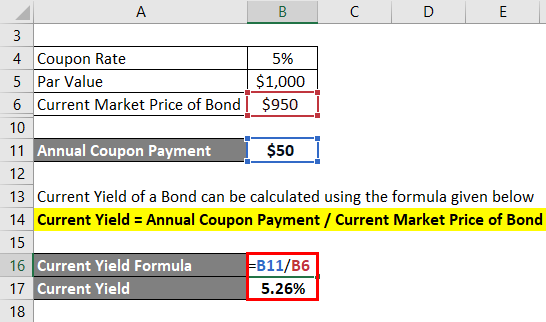

Current Yield Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

How To Calculate The Debt Yield Ratio Propertymetrics

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

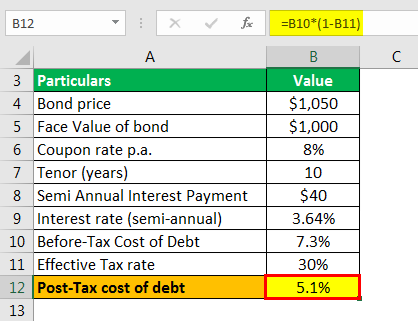

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc

How To Calculate The Debt Yield Ratio Propertymetrics

Weighted Average Cost Of Capital Wacc Magnimetrics

How To Calculate The Debt Yield Ratio Propertymetrics

Net Debt Formula And Calculator

/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

What Is Discount Yield

How To Calculate The Debt Yield Ratio Propertymetrics

Rental Yield Calculator

How To Calculate The Debt Yield Ratio Propertymetrics

Bond Yield Formula Calculator Example With Excel Template

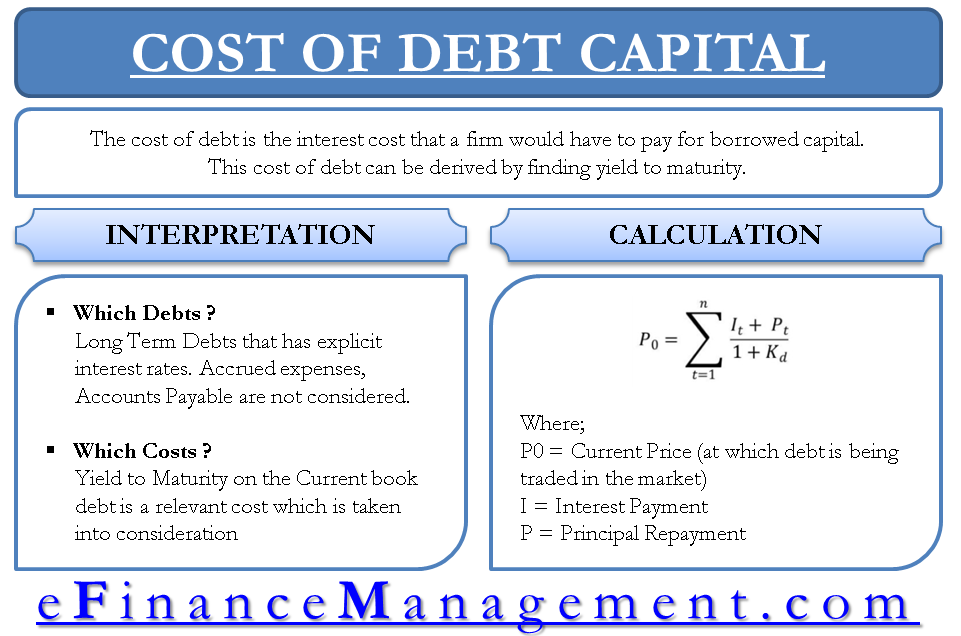

Cost Of Debt Should Be Interest Cost On Capital Yield To Maturity Efm

Yield To Maturity Ytm Formula And Bond Calculator

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity